What is ABA Routing Number?

Routing numbers are also referred to as "Check Routing Numbers", "ABA Numbers", or "Routing Transit Numbers" (RTN).

The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association (ABA).

This number identifies the financial institution upon which a payment is drawn.

Routing numbers may differ depending on where your account was opened and the type of transaction made.

Each routing number is unique to a particular bank, large banks may have more than one routing number for different area.

Use of ABA Routing Number

The ABA routing number provides information about bank the check is drawn from.

ABA routing number is also necessary for the check to be returned to the issuing bank for payment, a check will not be valid if the routing number is missing or wrongly entered.

Routing Number can be decoded as below, which help bank to process funds quickly and efficiently:

- The first two numbers of ABA routing number represents branch of the Federal Reserve that issued the check.

- The next two digits are a Routing Code.

- The next four are the bank's ABA identifier.

- The ninth digit is a checksum to verify the first eight digits.

How to Find ABA Routing Number?

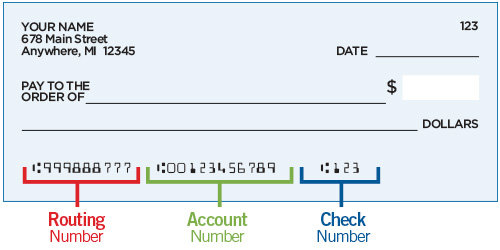

ABA Routing Number is 9-digit identification number present on bottom of your check. To know correct ABA Routing Number of your Bank branch follow below steps and refer the image given below:

Step 1: Locate the numbers on the bottom of your check, on the lower-left most corner.

Step 2: On the check, first nine digits are ABA routing number of your Bank. The remaining digits (excluding first nine digits) is your the account number followed by check number. Bank Routing Number is located between the symbol (a vertical line followed by a colon). For example in above image ABA Routing number is

For example in above image ABA Routing number is  999888777

999888777

and the account number is 00123456789. In most of the bank, check number is written after the account number which are sequential like 123 etc.

Step 3:You can verify your ABA routing number by entering your bank name or known routing number in the below given boxes. You can also find complete details about your bank like Bank's address, other branches of bank in your city, phone number etc. by searching them below.

Step 2: On the check, first nine digits are ABA routing number of your Bank. The remaining digits (excluding first nine digits) is your the account number followed by check number. Bank Routing Number is located between the symbol (a vertical line followed by a colon).

For example in above image ABA Routing number is

For example in above image ABA Routing number is  999888777

999888777

and the account number is 00123456789. In most of the bank, check number is written after the account number which are sequential like 123 etc.

Step 3:You can verify your ABA routing number by entering your bank name or known routing number in the below given boxes. You can also find complete details about your bank like Bank's address, other branches of bank in your city, phone number etc. by searching them below.

Find Routing Number of a Bank

Find Bank By Routing Number