What is ACH Routing Number?

ACH Routing Number stands for Automated Clearing House (ACH). This routing number is used for electronic financial transactions in the United States. ACH helps to improves payment processing efficiency and accuracy, and reduce expenses.

Banks offer ACH services for businesses who want to collect funds and make payments electronically in batches through the national ACH network.

Some typical ACH applications include:

ACH help to take advantage of the speed and efficiency of electronic payments and collections available through the ACH network, giving better control over the timing of payments that post to your bank account(s). ACH transactions are usually next-day entries when exchanged with other financial institutions. ACH functions include direct deposits and check conversions from paper to electronic.

Use of ACH Routing Number

ACH routing number is a nine digit number. The first four digits identify the Federal Reserve district where the bank is located. The next four numbers identify the specific bank. The last number is called as a check digit number which is a confirmation number.Some typical ACH applications include:

- direct deposit of payroll

- dividends

- annuities

- monthly payments and collections

- federal and state tax payments

ACH help to take advantage of the speed and efficiency of electronic payments and collections available through the ACH network, giving better control over the timing of payments that post to your bank account(s). ACH transactions are usually next-day entries when exchanged with other financial institutions. ACH functions include direct deposits and check conversions from paper to electronic.

How to Find ACH Routing Number?

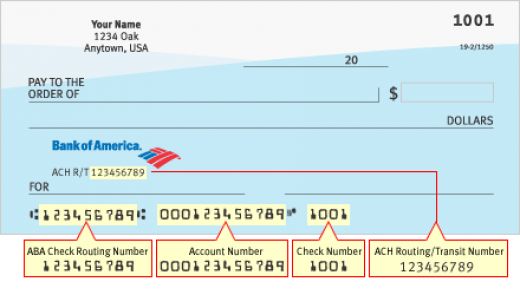

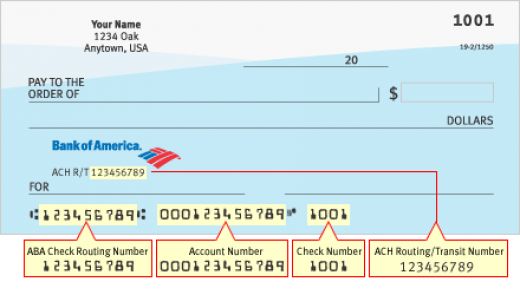

ACH Routing Number can be found on your check. Generally, ACH routing number and ABA routing number are same for all the banks. In the below given sample check ABA routing number is 123456789 and ACH routing number is also same i.e. 123456789. Some banks print ACH routing number separately on check (refer image below). Thus, we can easily identify the ACH routing number on the check. In case, if ACH routing number is not given on your check separately then in most cases it is same as ABA routing number.

Find Routing Number of a Bank

Find Bank By Routing Number